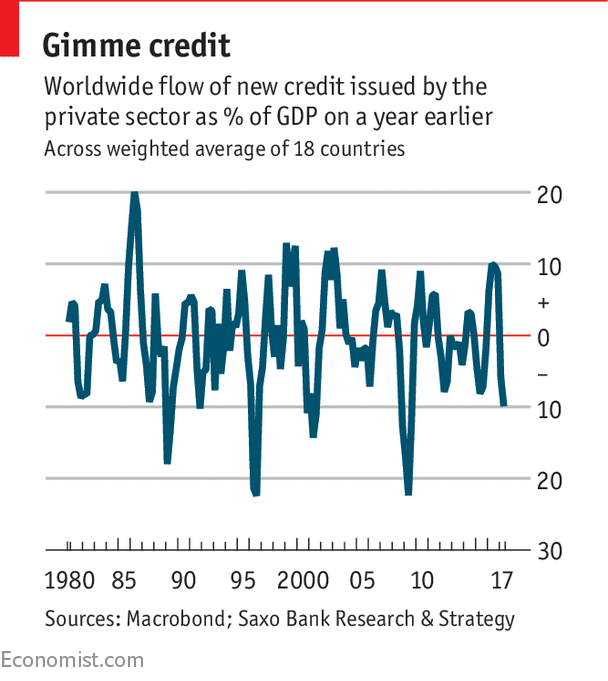

Saxo Bank thinks a slowdown in credit growth is bad news

IF THERE is a consensus at the moment, it is that the global economy is finally managing a synchronised recovery. The purchasing managers' index for global manufacturing is at its highest level for six years; copper, the metal often seen as the most sensitive to global conditions, is up by a quarter since May.

But Steen Jakobsen of Saxo Bank thinks this strength will not last. His leading indicator is a measure of the change in private sector credit growth. This peaked at the turn of the year and is now heading down sharply. Indeed the change in trend is the most negative since the financial crisis (see chart). Since this indicator leads the economy by 9-12 months, that suggests a significant economic slowdown either late this year or early in 2018. He says that

But Steen Jakobsen of Saxo Bank thinks this strength will not last. His leading indicator is a measure of the change in private sector credit growth. This peaked at the turn of the year and is now heading down sharply. Indeed the change in trend is the most negative since the financial crisis (see chart). Since this indicator leads the economy by 9-12 months, that suggests a significant economic slowdown either late this year or early in 2018. He says thatThis call for a significant slowdown coincides with several facts: the ECB’s QE programme will conclude by end-2017 and will at best be scaled down by €10 billion per