H/T Ryan

H/T Ryan

Read More, Comment and Share......

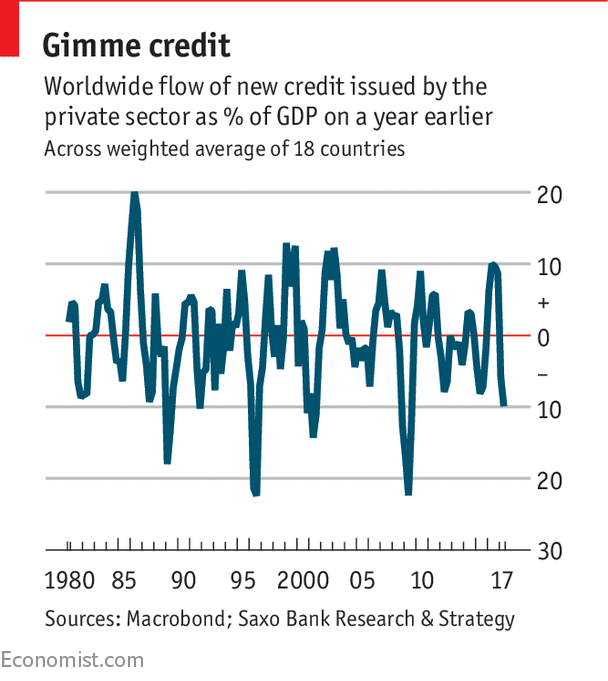

Saxo Bank thinks a slowdown in credit growth is bad news

IF THERE is a consensus at the moment, it is that the global economy is finally managing a synchronised recovery. The purchasing managers' index for global manufacturing is at its highest level for six years; copper, the metal often seen as the most sensitive to global conditions, is up by a quarter since May.

But Steen Jakobsen of Saxo Bank thinks this strength will not last. His leading indicator is a measure of the change in private sector credit growth. This peaked at the turn of the year and is now heading down sharply. Indeed the change in trend is the most negative since the financial crisis (see chart). Since this indicator leads the economy by 9-12 months, that suggests a significant economic slowdown either late this year or early in 2018. He says that

But Steen Jakobsen of Saxo Bank thinks this strength will not last. His leading indicator is a measure of the change in private sector credit growth. This peaked at the turn of the year and is now heading down sharply. Indeed the change in trend is the most negative since the financial crisis (see chart). Since this indicator leads the economy by 9-12 months, that suggests a significant economic slowdown either late this year or early in 2018. He says thatThis call for a significant slowdown coincides with several facts: the ECB’s QE programme will conclude by end-2017 and will at best be scaled down by €10 billion per

Read More, Comment and Share......

We’ll start with the obvious: the number one export for many countries here is crude oil or related petroleum products. Middle Eastern countries made up a significant portion of global oil export revenues during 2015 with shipments valued at $325 billion or 41.3% of global crude oil exports.

We’ll start with the obvious: the number one export for many countries here is crude oil or related petroleum products. Middle Eastern countries made up a significant portion of global oil export revenues during 2015 with shipments valued at $325 billion or 41.3% of global crude oil exports.

Saudi Arabia, Iraq, United Arab Emirates, Kuwait, Iran, and Oman were all among the top 15 exporters of crude oil in 2015. Russia and Kazakhstan, countries on the Central Asian part of the map, were also members of that same group.

Regimes in the region found that there were many other corollary benefits from this economic might. Unrest could be stifled by rising wealth, and these countries would also have more influence than they otherwise would in global affairs. Saudi Arabia is a good example in both cases, though a major driver of Saudi influence has been slipping in recent years.

Aside from exports of oil, there are some other interesting subtleties to this map. One of the most

Read More, Comment and Share......

The world’s biggest corporations have been riding a three-decade wave of profit growth, market expansion, and declining costs. Yet this unprecedented run may be coming to an end. Our new McKinsey Global Institute report, Playing to win: The new global competition for corporate profits, projects that the global corporate-profit pool, which currently stands at almost 10 percent of world GDP, could shrink to less than 8 percent by 2025—undoing in a single decade nearly all of the corporate gains achieved relative to the world economy during the past 30 years (exhibit).

From 1980 to 2013, vast markets opened around the world while corporate-tax rates, borrowing costs, and the price of labor, equipment, and technology all fell. The net profits posted by the world’s largest companies more than tripled in real terms from $2 trillion in 1980 to $7.2 trillion by 2013,1 pushing corporate profits as a share of global GDP from 7.6 percent to almost 10 percent. Today, companies

Read More, Comment and Share......

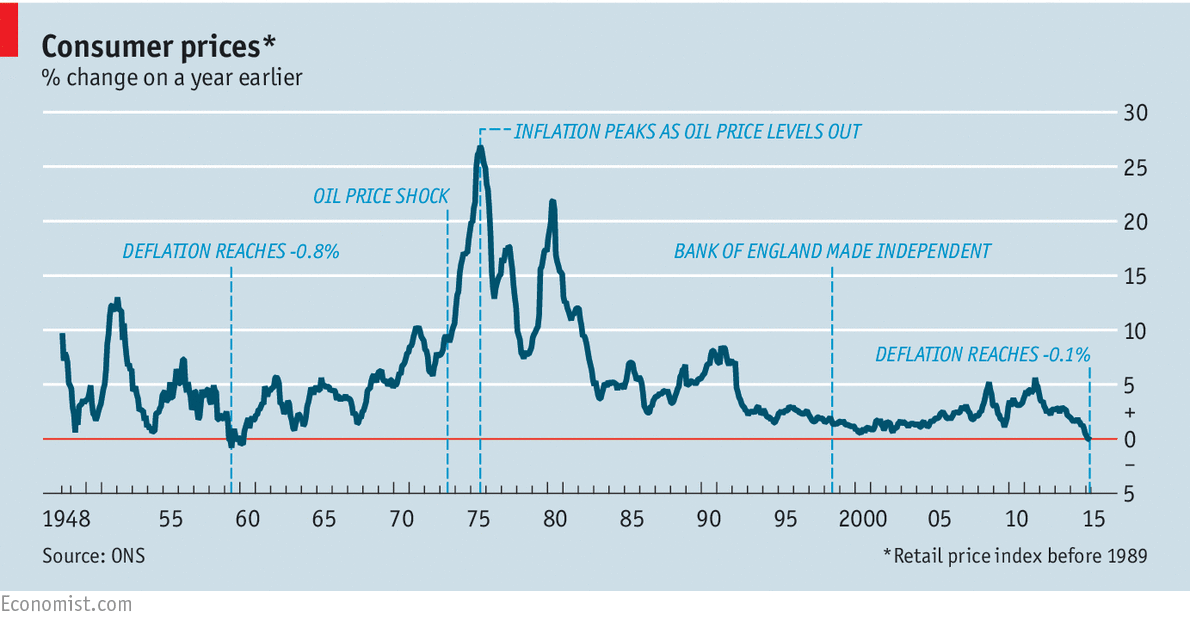

According to The Economist, in May 19th official statisticians announced that Britain entered deflation in April, with consumer prices standing 0.1% lower than a year earlier. It is first time since 1960 that annual inflation has been negative. Back then, prices pepped up again quickly. The Bank of England expects a similar rebound this time, on the basis that the recent fall in the price of food and fuel will be a one-off. But for inflation to return to the bank’s 2% target, sustained growth in wages is necessary. That means the bank is keeping a close eye on inflation expectations; if Britons start accepting lower pay rises on account of stagnant prices, deflation could persist.

According to The Economist, in May 19th official statisticians announced that Britain entered deflation in April, with consumer prices standing 0.1% lower than a year earlier. It is first time since 1960 that annual inflation has been negative. Back then, prices pepped up again quickly. The Bank of England expects a similar rebound this time, on the basis that the recent fall in the price of food and fuel will be a one-off. But for inflation to return to the bank’s 2% target, sustained growth in wages is necessary. That means the bank is keeping a close eye on inflation expectations; if Britons start accepting lower pay rises on account of stagnant prices, deflation could persist.

Here in the U.S. fears of deflation still linger with strength in the U.S. Dollar continuing to quash any strong moves in commodities. We've discussed it a few times before here and here. Tomorrow's GDP and PMI will be watched closely. At least it won't be a boring Friday morning.

Read More, Comment and Share......

I see no reason why not to stick with Shanghai at this point. They're behind us at in terms of supporting their economy and it's not an easy ride (as Ben Bernanke will attest).

According to BusinessInsider, a bunch of data about the state of China's economy came out Tuesday night, and altogether it told us one thing — nothing the government has been doing to save its economy from falling deeper into a slowdown is working.

Since November, China has cut benchmark interest rates three times, including once Saturday. It has also loosened mortgage policies to prop up the housing market.

But none of it's enough. Especially when you look at the data from Tuesday night.

Lets walk through the scariest stuff:

Read More, Comment and Share......

In the Industrial Revolution of the late 18th and early 19th centuries, one new force changed everything. Today our world is undergoing an even more dramatic transition due to the confluence of four fundamental disruptive forces—any of which would rank among the greatest changes the global economy has ever seen. Compared with the Industrial Revolution, we estimate that this change is happening ten times faster and at 300 times the scale, or roughly 3,000 times the impact. Although we all know that these disruptions are happening, most of us fail to comprehend their full magnitude and the second- and third-order effects that will result. Much as waves can amplify one another, these trends are gaining strength, magnitude, and influence as they interact with, coincide with, and feed upon one another. Together, these four fundamental disruptive trends are producing monumental change.

The first trend is the shifting of the locus of economic activi

Read More, Comment and Share......

Traders dumped high fliers and the broader stock market was slammed amid worries about the first profit decline in six years and more signs of nagging weakness in the U.S. economy.

Stocks fell sharply, as the VIX [ .VIX 15.44  +1.82 (+13.36%) ] jumped more than 13 percent. The Dow [ .DJI 17718.54

+1.82 (+13.36%) ] jumped more than 13 percent. The Dow [ .DJI 17718.54  -292.60 (-1.62%) ] was off 292 points at 17,718 Wednesday, and the S&P 500 [ .INX 2061.05

-292.60 (-1.62%) ] was off 292 points at 17,718 Wednesday, and the S&P 500 [ .INX 2061.05  -30.45 (-1.46%) ] fell nearly 1.5 percent to 2061. The Nasdaq [ .IXIC 4876.52

-30.45 (-1.46%) ] fell nearly 1.5 percent to 2061. The Nasdaq [ .IXIC 4876.52  -118.21 (-2.37%) ], affected by selling in tech and biotech, lost 2.4 percent.

-118.21 (-2.37%) ], affected by selling in tech and biotech, lost 2.4 percent.

"It had a big run. It's only natural to see a correction," said Steve Massocca, Wedbush managing director. "We had excessive ebullience and some of that is burning off. I think that durable goods numbers weren't particularly good today. I think people are starting to get concerned that king dollar is going to cause earnings issues. A lot of companies are in their quiet periods so the stock buybacks are halted."

Stocks tanked in late morning but had

Read More, Comment and Share......

Unless we can dramatically improve productivity, the next half century will look very different. The rapid expansion of the past five decades will be seen as an aberration of history, and the world economy will slide back toward its relatively sluggish long-term growth rate.

Over this time, two factors powered exceptionally fast GDP growth

Read More, Comment and Share......

Indeed, I've read much concern over this area as oil collapsed so it does merit a warning. From ZeroHedge:

Indeed, I've read much concern over this area as oil collapsed so it does merit a warning. From ZeroHedge:

The S&P 500 Energy sector stocks are down over 12% year-to-date, tumbling over 3% today to fresh 20-month lows. The spread (or risk) of high-yield energy credits surged again today, breaking above 850bps for the first time... The overall high-yield credit market is being dragged wider by this contagion as hedgers try to contain the collapse that is possible. For now, the S&P 500 remains entirely ignorant of the fact that over a third of its CapEx was expected to come from this crushed sector...

According to DB

US private investment spending is usually ~15% of US GDP or $2.8trn now. This investment consists of $1.6trn spent annually on equipment and software, $700bn on non-residential construction and a bit over $500bn on residential. Equipment and software is 35% technology and communications, 25-30% is industrial equipment for energy, utilities and agriculture, 15% is transpor

Read More, Comment and Share......

As the price of oil extends a free fall that began this summer, countries around the world that rely on oil revenues are bracing for an imminent economic and budget hit. The drop is widening budget gaps in the Gulf states like Saudi Arabia, the United Arab Emirates, Qatar, Oman and Bahrain that rely heavily on oil to pay government services.

With oil and gas production accounting for some 70% of Russia's government spending, Moscow also faces a big shortfall—after budgeting based on $100-a-barrel oil for 2015. Russia's economic growth was already slowing before the plunge in oil prices. Trade sanctions imposed by the U.S. and Europe—in response to the invasion of the Ukraine—will further crimp growth and government spending.

The impact of budget gaps among big producers like Saudi Arabia and Russia, though, will be softened somewhat by large reserves built up during boom years. But a protracted era of cheap oil would force them to undertake serious belt-tightening.

Note: Click on a c

Read More, Comment and Share......

IT HAS been a consistent theme of this blog in recent months that global growth has been slowing, a fact some investors may have missed in the good news about American GDP. The latest confirmation came from the World Trade Organisation, which cut its forecast for trade growth this year from 4.6% to 3.1% and for 2015 from 5.3% to 4%. The WTO doesn't forecast economic growth directly; it takes its lead from other international organisations (Rabo Bank reckons the IMF is set to reduce its growth forecast in the next few weeks).

What is interesting from the WTO announcement is that even the revised forecast relies on a bit of optimism. Actual trade growth in the first half of the year was just 1.8%; the organisation is relying on a rebound in the second half. The first half regional numbers were revealing; Asia increased its exports by 4.2% but its imports by just 2.1%. In effect, it has been gaining market share. North America was more balanced, increasing exports by 3.3% and imports by

Read More, Comment and Share......

Among other things, I’m known to be a “reductionist.” In my line of work you must be good at pinpointing what to focus on – that is, the major underlying truths and problems in a situation. I then become obsessive about solving or fixing whatever they may be. This combination is what perhaps has lead to my success over the years and is why I’ve chosen to be so outspoken about shareholder activism, corporate governance issues, and the current economic state of America. Currently, I believe that the facts “reduce” to one indisputable truth which is that we must change our system of selecting CEOs in order to stay competitive and get us out of an extremely dangerous financial situation. With exceptions, I believe that too many companies in this country are terribly run and there’s no system in place to hold the CEOs and Boards of these inadequately managed companies accountable. There are numerous challenges we are facing today whether it be monetary policy, unemployment, income inequali

Read More, Comment and Share......

Are Corporate taxes in the U.S. too high versus other developed nations? Corporate execs would have you believe so. CNBC takes a look at the facts. I seem to recall this chart from the Federal Reserve. Anyone surprised? lol

facts. I seem to recall this chart from the Federal Reserve. Anyone surprised? lol

Read More, Comment and Share......

The topic of income inequality and its effects has been the subject of countless analysis stretching back generations and crossing geopolitical boundaries. Despite the tendency to speak about this issue in moral terms, the central questions are economic ones: Would the U.S. economy be better off with a narrower income gap? And, if an unequal distribution of income hinders growth, which solutions could do more harm than good, and which could make the economic pie bigger for all?

Given the decades--indeed, centuries--of debate on this subject, it comes as no surprise that the answers are complex. A degree of inequality is to be expected in any market economy. It can keep the economy functioning effectively, incentivizing investment and expansion--but too much inequality can undermine growth.

Higher levels of income inequality increase political pressures, discouraging trade, investment, and hiring. Keynes first showed that income inequality can lead affluent households (Americans include

Read More, Comment and Share......

Given today's big GPS miss (-2.9% vs. expected -1.8%), I felt we should take a look at the historical performance of the S&P500 when it comes to recessions. For all of those who harp that the stock market is not the economy, past reactions to recessions is certainly interesting.

Click image to enlarge.

Chart courtesy of ElliottWaveAnalytics

Read More, Comment and Share......

Ashraf says it's all about European CPI and GDP.

Read More, Comment and Share......

Read More, Comment and Share......

During the last few years, a lot of hype has been heaped on the Brics (Brazil, Russia, India, China, and South Africa). With their large populations and rapid growth, these countries, so the argument goes, will soon become some of the largest economies in the world – and, in the case of China, the largest of all by as early as 2020. But the Brics, as well as many other emerging-market economies – have recently experienced a sharp economic slowdown. So, is the honeymoon over?

Brazil's GDP grew by only 1% last year, and may not grow by more than 2% this year, with its potential growth barely above 3%. Russia's economy may grow by barely 2% this year, with potential growth also at around 3%, despite oil prices being around $100 a barrel. India had a couple of years of strong growth recently (11.2% in 2010 and 7.7% in 2011) but slowed to 4% in 2012. China's economy grew by 10% a year for the last three decades, but slowed to 7.8% last year and risks a hard landing. And South Africa grew by

Read More, Comment and Share......

The sharp increases in investment that have driven China’s rapid economic growth for the past 30 years are not sustainable, and consumers can’t provide additional demand unless wealth is redistributed toward Chinese households. The most obvious consequence of rebalancing is that it will result in much slower growth over the medium term. While many economists now project that average annual economic growth will fall to between 5 and 7 percent a year during the next decade, I expect it to slow even more, perhaps to 3 to 4 percent a year. In modern history, no country that has experienced an investment-driven growth “miracle” has avoided a slowdown (such as Japan’s after 1990) that surprised even the pessimists, and it is hard to find good reasons to think China will be an exception.

As a result, many businesses in China and around the world will thrive, while others will be forced to make wrenching changes. Here are four predictions about the ways China’s rebalancing will affect the

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________