You will find more statistics at Statista

Read More, Comment and Share......

You will find more statistics at Statista

Read More, Comment and Share......

Technology is only as good as the materials it is made from.

Much of the modern information era would not be possible without silicon and Moore’s Law, and electric cars would be much less viable without recent advances in the material science behind lithium-ion batteries.

That’s why graphene, a two-dimensional supermaterial made from carbon, is so exciting. It’s harder than diamonds, 300x stronger than steel, flexible, transparent, and a better conductor than copper (by about 1,000x).

If it lives up to its potential, graphene could revolutionize everything from computers to energy storage.

The following infographic comes to us from 911Metallurgist, and it breaks down the incredible properties and potential applications of graphene.

While the properties and applications of graphene are extremely enticing, there has one big traditional challenge with graphene: the cost of getting it.

As you can imagine, synthesizing a material that is one atom thick is a process that has some major limitations. Since a sheet of graphene 1 mm thick (1/32 of an inch) requires three million layers of atoms, graphene has been quite cost-prohibitive to produce in large amounts.

Back in 2013, Nature reported that one micrometer-sized flake of graphene costed more than $1,000, which made graphene one of the most expensive materials on Earth. However, there has been quite some progress in this field since then, as scientists search for the “Holy Grail” in scaling graphene production processes.

By the end of 2015, Deloitte estimated that the market price per gram was close to $100. And today, graphene can now be ordered straight from a supplier like Graphenea, where multiple products are offered online ranging from graphene oxide (water dispersion) to monolayer graphene on silicon wafers.

One producer, NanoXplore, even estimates that graphene is now down to a cost of $0.10 per gram for good quality graphene, though this excludes graphene created through a CVD process (recognized as the highest level of quality available for bulk graphene).

The following graphic from Nature (2014) shows some methods for graphene production – though it should be noted that this is a quickly-changing discipline.

As the price of graphene trends down at an impressive rate, its applications will continue to grow. However, for graphene to be a true game-changer, it will have to be integrated into the supply chains of manufacturers, which will still take multiple years to accomplish.

Once graphene has “real world” applications, we’ll be able to see what can be made possible on a grander scale.

Courtesy of VisualCapitalist

Read More, Comment and Share......

Iff you're hesitant to make stock purchases at these levels, you're not alone.

NEW POST: Why Warren Buffett Is So Reluctant To Call Stocks A ‘Bubble’ https://t.co/HSqxmgC6ep pic.twitter.com/BPSOjaioMX

— Jesse Felder (@jessefelder) March 1, 2017

Last week I updated the Warren Buffett yardstick, market cap-to-GNP. The only time it was ever higher than it is today was for a few months at the top of the dotcom mania.

The Most Broadly Overvalued Moment in Market History https://t.co/XleMnXh3NZ by @hussmanjp pic.twitter.com/AjviMnPt6U

— Jesse Felder (@jessefelder) March 7, 2017

However, when you look under the surface of the market-cap-weighted indexes at median valuations they are currently far more extreme than they were back then. As my friend John Hussman puts it, this is now “the most broadly overvalued moment in market history.”

Nothing to see here. Move along pic.twitter.com/ELZojkcElM

— Eric Pomboy (@epomboy) March 3, 2017

Another way to look at stock prices is in relation to monetary velocity and here, too, we see something totally unprecedented.

Finally, when you look at equity valuations relative to economic growth it quickly becomes clear that investor euphoria has entered uncharted territory.

Could current valuations be higher than 1999 and 1929? Our latest article might surprise you. https://t.co/jUe5q8uhTg pic.twitter.com/cMbJwvRYru

— Michael Lebowitz (@michaellebowitz) February 28, 2017

Critics will say “valuations aren’t an effective timing tool.” I’m not saying they are. But if you believe that “the price you pay determines your rate of return” then at current prices you must believe we currently face some of the worst prospective returns in history.

Courtesy of Felder

Read More, Comment and Share......

Believe it or not, autonomous vehicles have been many decades in the making.

Even in 1939, General Motors had an exhibit called “Futurama” at the New York World’s Fair that presented a model of the world 20 years in the future. Central to this display was a system of automated highways and vast suburbs, with a focus on how automation could reduce traffic congestion and lead to the free-flowing movement of people and goods.

Since then, many autonomous vehicle concepts have popped up at various times – but they have always fell short due to technical limitations. Only recently, due to advances in technology, have self-driving cars been able to overcome three primary engineering challenges: sensing the surrounding environment, processing information, and reacting to that environment.

Today, the future for autonomous vehicles is bright, and it is expected that there will be millions of self-driving cars on the road by 2035, creating a multi-billion dollar market.

The following infographic comes to us from Get Off Road, and it shows the history of autonomous vehicles, how they work, the technical challenges overcome so far, and what the near-future of driverless cars may look like.

Read More, Comment and Share......

Over the last few years, we’ve seen a significant downtick in the number of IPOs issued by companies, but will 2017 break that trend? So far this year we have seen five companies go public on a U.S. stock exchange, and today we saw the first tech IPO of the year with Snap, Inc.

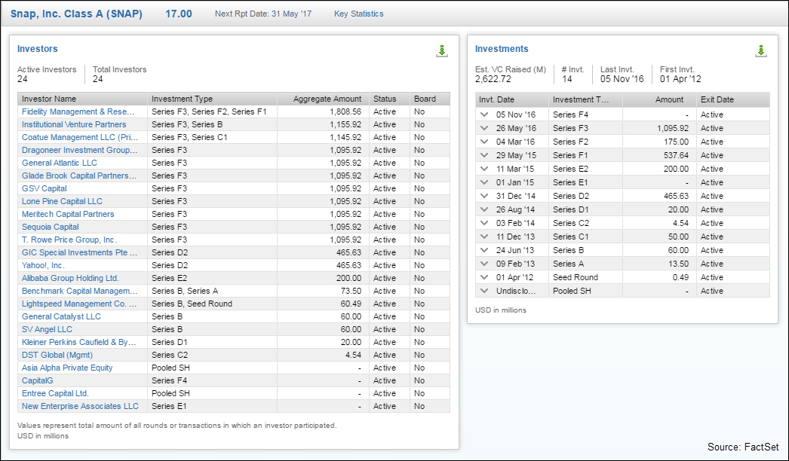

Snap, Inc. is technology and social media company known for its mobile app Snapchat, which allows users to share photos and videos with friends for moments to hours before disappearing. Founded in July 2011, what began as a tech start-up garnered 23 active investors and raised around $2.6 billion in venture capital backing.

Now that Snap, Inc. has gone public with an IPO priced at $17 per share, ahead of the expected $14-$16 a share range, it’s trickier to forecast its performance. Looking at some of Snap’s numbers, investment attractiveness it likely to be in the eye of the beholder.

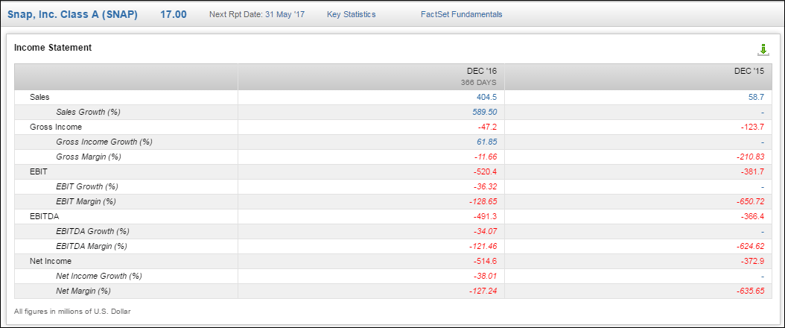

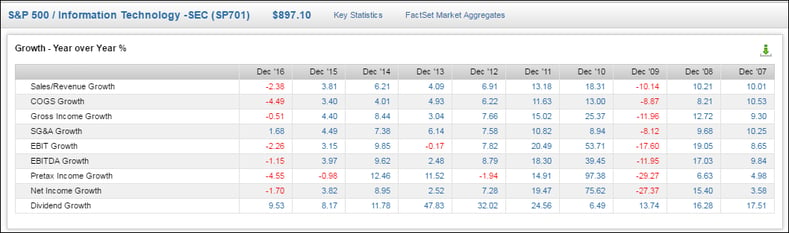

The company’s year-over-year sales growth as well as its EBIT growth are certainly noteworthy. Snap’s year-over-year sales growth is roughly 589% with $58.7 million in revenues in 2015 and $404.5 million in revenues in 2016. Additionally, it saw 36.32% decline in EBIT, which is significantly less than an aggregate of companies similar to it.

The biggest buzz since Snap’s initial IPO announcement was the large net losses of the company; surprising, since historically the company had seemed profitable to the public eye. With net losses of over $514 million, many investors are worried about Snap’s ability to become profitable over time. Additionally, year-over-year net income declined 38%. While this has probably influenced some potential shareholders, it seems like there is still a lot of optimism in the investing community around the Snap IPO and growth for the company in the future.

To give perspective on Snap’s recently reported financials, the S&P 500 Technology Sector as a whole saw a 2.26% decline in the 12 months ending in December 2016. Perhaps more significantly, Snap’s fellow social media competitors Twitter (TWTR) and Facebook (FB) saw 18.4% and 98.4% growth in EBIT respectively.

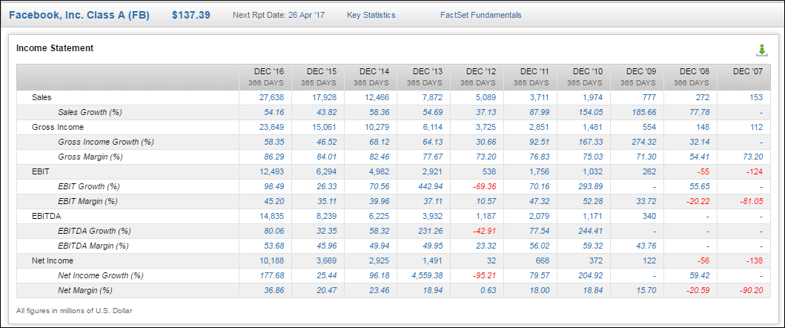

Compared to its peers in the tech industry, Snap’s sales growth gets solid marks, but its EBIT growth could conceivably raise concerns. Is this something interested investors can bank on for post-IPO performance? We can look back at Twitter and Facebook the year leading up to their IPOs to understand the performance of post-IPO tech companies.

Looking first at Twitter, which had its initial public offering in November 2013, sales growth was also very strong, but EBIT and net income growth were lacking, as with Snap. Since then, sales growth has decreased from over 109% year-over-year to roughly 14% year-over-year in 2016. While EBIT growth increased from -724% in 2013 to over 18% in 2016, the company appears to have struggled to keep that number positive. There is a similar trend with net income growth over time as well. These metrics are very similar to Snap’s pre-IPO numbers.

Facebook, another key competitor of Snap, has a slightly different story than Twitter. While Facebook also had strong sales growth and negative EBIT and net income growth prior to its IPO in 2013, it has consistently grown year-over-year since then to become currently profitable. Sales have consistently grown almost 50% year-over-year since 2013. Additionally, Facebook was able to turn around negative EBIT growth prior to its IPO in 2012 by increasing EBIT by over 442% in 2013. Since its IPO, Facebook has had positive net income, increasing in 2016 by an astounding 177%.

Ahead of its IPO, SNAP has significantly more capital at its disposal than any of its peers at the same time, with 24 investors and $14.29 billion.

| Company | aggregate investor amount (millions) |

| Snap, Inc. | $14,287.56 |

| Twitter, Inc. | $4,479.61 |

| Facebook, Inc. | $2,513.40 |

| Fitbit, Inc. | $321.24 |

As we’ve seen, an estimated $2.62 billion of that capital was raised from venture capital, while Facebook ($1.54) and Twitter ($1.55) both had more than billion dollars less prior to their IPO. Snap has clearly been able to raise more funds, which could translate into immediate performance, unlike with Twitter and Facebook, which performed poorly early on.

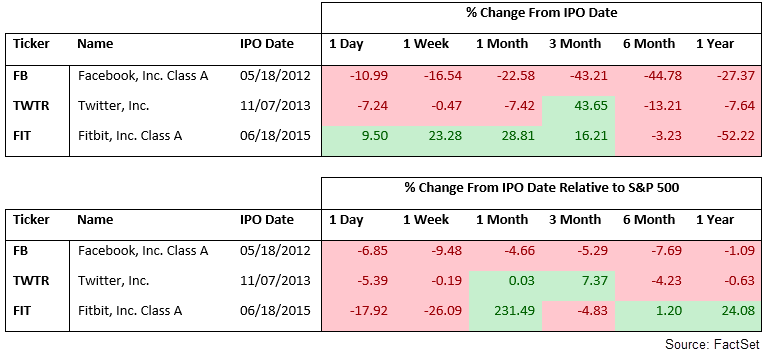

Looking at the IPOs of Facebook, Twitter, and wearable technology company Fitbit, Inc., on an absolute basis, we see an overall price decline over the six months following their IPOs. When comparing the companies to the market, only Fitbit, Inc. outperformed, and that was after suffering initial declines in its first few weeks.

We don’t know what the Snap IPO could lead to down the line. However, with financials that line up closely with peers Twitter and Facebook, two divergent paths seem possible. Will Snap follow in the footsteps of these competitors, or will it start a new trend altogether in the tech industry? With an IPO said to be the biggest since Alibaba (BABA) in 2014, it will be interesting to see if the company can live up to the hype.

Courtesy of FactSetInsights

Read More, Comment and Share......

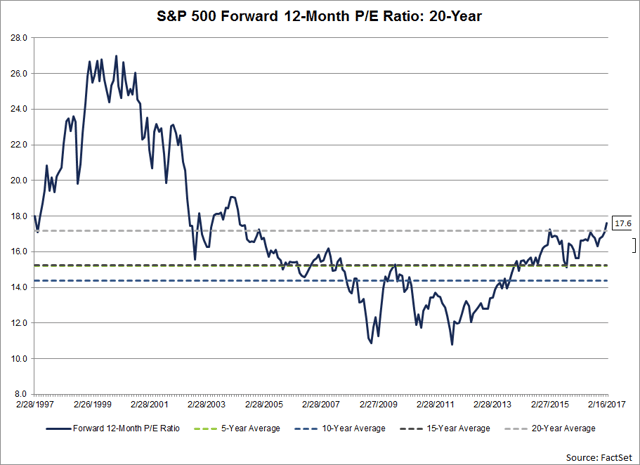

I found this interesting (the rise) however I have my own reservations because of the possible change in rates and inflation in 2017. When inflation rises, interest rates also normally rise to maintain real rates within an appropriate range. PE ratios need to decline to reflect the increase in the earnings discount rate. Another way to look at it is that equities then face more competition for money from fixed income instruments. The cost of equities must therefore decline to keep or attract investors. Then there is the Rule of 20 to consider.

During the past week (on February 15), the value of the S&P 500 closed at yet another all-time high at 2349.25. As of today, the forward 12-month P/E ratio for the S&P 500 stands at 17.6, based on yesterday’s closing price (2347.22) and forward 12-month EPS estimate ($133.49). Given the high values driving the “P” in the P/E ratio, how does this 17.6 P/E ratio compare to historical averages? What is driving the increase in the P/E ratio?

The current forward 12-month P/E ratio of 17.6 is now above the four most recent historical averages: five-year (15.2), 10-year (14.4), 15-year (15.2), and 20-year (17.2).

In fact, this week marked the first time the forward 12-month P/E has been equal to (or above) 17.6 since June 23, 2004. On that date, the closing price of the S&P 500 was 1144.06 and the forward 12-month EPS estimate was $65.14.

Back on December 31, 2016, the forward 12-month P/E ratio was 16.9. Since this date, the price of the S&P 500 has increased by 4.8% (to 2349.45 from 2238.83), while the forward 12-month EPS estimate has increased by 0.5% (to $133.49 from $132.84). Thus, the increase in the “P” has been the main driver of the increase in the P/E ratio to 17.6 today from 16.9 at the start of the first quarter.

It is interesting to note that analysts are projecting record-level EPS for the S&P 500 for Q2 2017 through Q4 2017. If not, the forward 12-month P/E ratio would be even higher than 17.6.

Courtesy of Factset

Read More, Comment and Share......

Rules and regulations exist to let us know what behaviors we should expect from the people we do business with. Sometimes, good sense or social convention overtake these rules — and they don’t matter so much. Just about everyone wears seat-belts these days (we all know how much they improve our odds of survival in an accident); the ranks of underage smokers have plummeted (it’s no longer cool). Once the toothpaste is out of the tube, as they say, there’s no cramming it back in.

Such is the case with the Department of Labor’s fiduciary rule. On Friday, President Trump asked the Labor Department to review the rule, which requires brokers working with retirement savers to put the interest of their clients ahead of their own. After years of work on it, the regulation was finalized last year by the Obama administration.

At first blush, this looks like a big way the Trump administration could directly affect everyday investors. As it turns out, whether the fidicuary rule hurts you isn’t up to Trump — it’s up to you.

Let me explain. Whether it is overturned by the Trump administration is besides the point. The Labor Department has already taken the key language offline (you can see the earlier text here). Even before the government announced the new standard of care for advisers on retirement accounts, the public had figured it out: Investors have been moving away from high-cost, conflicted advice (with undisclosed kickbacks to brokers on the side) and toward low-cost investment advice where the adviser acts transparently in the investor’s best interests.

They have voted with their feet, and with their dollars.

Long before the 2011 staff report of the Securities and Exchange Commission (Study on Investment Advisers and Broker-Dealers) recommended a uniform fiduciary rule for all investors, the industry was moving in that direction. The fiduciary rule is not shaping investor behavior, it is now catching up with it. It has been six years since the SEC study suggested the standard; while the commission has been stalemated by politics and the Labor Department by the new administration, they are both now far behind the curve.

Consider:

— Vanguard, the industry leader in low-cost indexing, has attracted $3 trillion since the 2008 financial crisis. It now manages about $4 trillion.

— Blackrock, the world’s largest investment firm, runs over $4 trillion. It notes that it is a “fiduciary for our clients” regardless of whether the new rule is implemented

— Software-managed investing (aka robo-advisors) and Hybrid (robo/adviser combos) will be $100 billion in the next few years. They already are managing almost $75 billion, according to Michael Kitces, an expert on the advisory business. Kitces notes that just the top five robos – Vanguard Personal Advisor Services (over $40 billion), Schwab Intelligent Portfolios (over $10 billion), Betterment (over $7 billion), Wealthfront ($5 billion) and Personal Capital ($3.4 billion) – alone account for $65 billion in assets under management.

Had it gone into effect as planned in April 2017, the fiduciary rule was likely to have accelerated the process of money moving from expensive and conflicted advice to advice that is lower cost and in the clients’ best interest. Changing the new rule implementation plan won’t stop the underlying trend – at worst it might slow it somewhat.

Regardless, the change is now inevitable. Industry expectations, based on an A.T. Kearney study, are that by 2020, “the DOL’s new fiduciary rule will result in a $2 trillion asset shift” that will save investors roughly $20 billion by not having to pay commissions.

Look at the biggest wirehouses as an example. They had begun a shift toward fee-based accounts several years ago. Three years ago, 27 percent of Morgan Stanley’s client assets were fee-based; today $855 billion of $2.1 trillion in assets, or more than 40 percent of client assets, are in fee-based accounts. The shift is similar for Bank America Merrill Lynch’s more than 14,000 advisers – they report an increase from brokerage to fee-based for their $2.1 trillion in client assets. The trend was similar for Wells Fargo’s $480 billion in assets under management.

In the early 2000s, retail investors whose investments were at these big firms had commission-based brokerage accounts. The primary rules that covered the behavior of brokers were from FINRA, the industry’s self-regulating organization. As you would imagine, letting the industry regulate itself led to all manner of expensive, opaque, conflicted advice that often worked against the interest of the investor, and toward the broker’s financial interest.

Investors have decided that Caveat emptor is not what they want governing their retirement accounts. Having the fiduciary rule in place would surely protect those investors who have yet to figure out who is really working for them. It would be nice to discover that the new administration was more “investor friendly.” But it was not the rules that moved the big firms toward a fee-based business model – market forces did.

Whether the fiduciary rule stays or not, the investing public has figured out what the proper standard should be. Investors are not waiting for the government to make the finance industry put investors’ interests first.

As market forces have revealed, they are insisting on it themselves.

Courtesy of Ritholtz

Read More, Comment and Share......

Facebook is getting into a new type of networking.

Facebook is getting into a new type of networking.

The social media giant said this week that it is rolling out new features in the US and Canada to let businesses post job openings, and prospective workers find and apply to them through Facebook. “This new experience will help businesses find qualified people where they’re already spending their time—on Facebook and on mobile,” the company said in a blog post.

The system Facebook debuted on Feb. 15 aims to minimize hassle for job-seekers and employers, while also giving both more reasons to use Facebook products. Businesses will be able to post jobs and track applications directly from a company Facebook page, as well as communicate with applicants through Facebook Messenger. They can also pay Facebook to promote their job listings to a wider audience.

Job-seekers will see posts in their news feed and integrated with other posts on business pages. They’ll also be able to check “Jobs on Facebook,” a designated landing page for job listings, pegged to location and sortable by industry (e.g., “real estate,” “restaurant/cafe,” “education”) and job type (e.g., “full-time,” “internship,” “volunteer”).

(Facebook)

(Facebook)

Already, warning cries are being issued for LinkedIn, (which ironically just underwent a redesign that makes it look a lot more like Facebook). As the chief player in the online-networking space, it’s true that LinkedIn could be in for some trouble. But such comparisons also miss a bigger point: Facebook is going after a different and much more significant job market.

First, the social network absolutely dwarfs LinkedIn in terms of users; it’s fast approaching 2 billion a month, while LinkedIn had just 106 million monthly active users as of the third quarter of 2016.

Next, there’s the matter of demographics. LinkedIn caters to the mid- to high-skilled job market. Its basic platform is free, but 17% of revenue comes from selling “premium” subscriptions that range from $25 to $100 a month. The site also features “influencers,” who are typically successful businesspeople and entrepreneurs—for example, Richard Branson, Bill Gates, and Arianna Huffington.

Per a November 2016 report from Pew Research Center, 50% of Americans with a college degree or higher used LinkedIn from March to April 2016, compared with just 12% who had a high school degree or less. Forty-five percent of people earning at least $75,000 a year were on the site, versus 21% of those who make less than $30,000.

Facebook, with its mission of “connecting the world,” has appealed to a broader audience. The same Pew report found that Facebook was used by 77% to 82% of Americans of all education levels. Facebook was also used by at least 75% of US adults in every income bracket, and most popular among the lowest earners.

When it comes to matching employers with job seekers, this means Facebook has a much bigger space to play in. Facebook’s users include LinkedIn’s “thought leaders” and white-collar professionals, but they’re also people seeking hourly positions, part-time work, and other opportunities that they’d probably find on sites like Monster, Indeed, or Craigslist long before LinkedIn. Facebook’s job listings for the New York metro area currently include apprentice fitness coach, salon assistant, and professional valet driver.

“We’re taking the work out of hiring by enabling job applications directly on Facebook,” Andrew Bosworth, Facebook’s VP of business and platform, said in a statement. “It’s early days but we’re excited to see how people use this simple tool to get the job they want and for businesses to get the help they need.”

For Facebook, that’s a huge opportunity. For LinkedIn, it was only ever a missed one.

Courtesy of QZ

Read More, Comment and Share......

A parade of up-and-coming musicians from Universal Music took the stage at the Ace Hotel in downtown Los Angeles Saturday in a pre-Grammy Awards performance for a room full of the executives who will make or break their careers.

A parade of up-and-coming musicians from Universal Music took the stage at the Ace Hotel in downtown Los Angeles Saturday in a pre-Grammy Awards performance for a room full of the executives who will make or break their careers.

Talent bookers from James Corden’s late-night show, marketing executives from top brands and executives from Spotify Ltd. and YouTube looked on. Sandwiched in between tables for Apple Inc., an imposing player in online music, and Pandora Media Inc., owner of the world’s largest online radio service, sat executives from a new act trying to break onto the scene: Facebook Inc.

The world’s largest social network has redoubled its efforts to reach a broad accord with the industry, according to interviews with negotiators at labels, music publishers and trade associations. A deal would govern user-generated videos that include songs and potentially pave the way for Facebook to obtain more professional videos from the labels themselves.

“We’re hopeful that they are moving towards licensing music for the entire site,” said David Israelite, president of the National Music Publishers Association, an industry trade group.

Facebook’s interest in music rights is inextricably linked to its growing interest in video. Having siphoned ads away from print, online companies have recently targeted TV, which attracts about $70 billion in advertising a year. While Facebook faces competition from Twitter Inc. and Snapchat Inc., its main rival is Google, and music is one of the most popular types of videos on Google’s YouTube service. Facebook declined to make an executive available for an interview.

Licensing to music on Facebook would have huge ramifications for the music industry, which is fighting to grab a larger share of the money from online services. With nearly 2 billion users and a growing advertising business, Facebook could provide billions in new sales for the music industry.

Beyond the revenue gains, the music industry could use a deal with Menlo Park, California-based Facebook to exert more pressure on YouTube. Music executives have long assailed what they say is YouTube’s lax approach to copyright enforcement -- even though the video-sharing website is the most popular in the world for music, has catapulted many young artists to stardom and delivered $1 billion in ad revenue to the industry last year.

An agreement with Facebook could also serve as a blueprint for deals with other social-media companies, like Snapchat.

On the other hand, providing Facebook users with another way to get music for free could disrupt the music industry’s recent surge in sales from paid services like Spotify.

The talks with Facebook are complex, involving how to prevent copyright violations in user-generated videos, so a deal could be a couple months away or more.

Facebook has reassured the music industry that the company will police piracy and share ad sales. Music executives are also encouraged because Facebook in January hired Tamara Hrivnak, a well-liked former record executive who also spent time at YouTube.

Video consumption on Facebook has grown to billions of views over the past couple of years, as TV networks, news organizations and users experiment with the site much like they once did with YouTube. The results have encouraged Facebook to fund original videos, though those plans are still being developed.

For Facebook to obtain professional video -- both music and otherwise -- it may have to alleviate concerns about how clips will be presented. At the moment, most Facebook users see videos in their newsfeed, where a clip from a TV show may be followed by a baby photo and then a friend complaining about romantic frustrations.

Facebook must also finish a system to police copyright-infringing material akin to Content ID, the system used by YouTube. Videos on the site already feature a lot of music for which artists don’t receive royalties -- a major source of tension.

Shares of the Facebook fell 0.3 percent to $133.78 at 10:45 a.m. in New York. They closed at a record $134.20 on Feb. 8.

Israelite speaks for many in the music industry when he expresses doubts about the latest online giant to come knocking on the door. Music executives blame large technology companies for using music to sell services and devices without properly compensating artists.

“Facebook is a very valuable company, making a lot of money, and in part because of the music on the site,” Israelite said, adding the social network is protected by the Digital Millennium Copyright Act, the same law that can shield YouTube from responsibility for pirated material. “We are looking forward to being business partners with Facebook. If that doesn’t happen, you’ll see the situation turn very quickly.”

After years of declining sales, the music industry is growing again thanks to the popularity of paid streaming services from Spotify and Apple. Label executives are reluctant to give their music to another free service for fear it could slow that growth.

The music industry has spent the better part of the last year fighting YouTube in the press, and trying to get laws changed so that the video-sharing service bears more responsibility for policing clips that infringe copyrights. The labels took up that fight just as they were negotiating new long-term licensing agreements with YouTube, hoping the pressure would at least result in more favorable deals.

“Facebook definitely has the size and scale, but the tribal nature of music preferences is different than a feed or news stories or cute cat videos,’’ said Vickie Nauman, a music industry consultant. “To be successful, it will not only need to envision a great music experience but also have to navigate the web of label and publisher rights and relations. No small feat.’’

Courtesy of Bloomberg

Read More, Comment and Share......

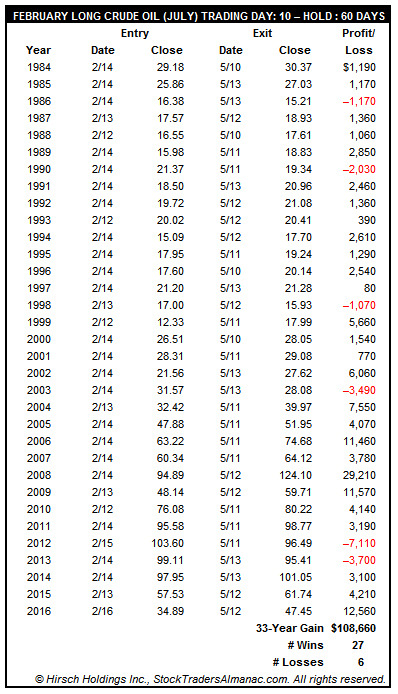

Crude oil has a tendency to bottom in mid-February and then rally through July with the bulk of the seasonal move ending in late April or early May. It is that early February low that can give traders an edge by buying ahead of a seasonally strong period. Going long crude oil’s July contract on or about February 14 and holding for approximately 60 days has been a profitable trade 27 times in 33 years, including the last three years straight, for an 81.8% win ratio with a cumulative profit of $108,660 (based upon trading a single crude oil futures contract excluding commissions and taxes).

Crude oil’s seasonal tendency to move higher in this time period is partly due to continuing demand for heating oil and diesel fuel in the northern states and partly due to the shutdown of refinery operations in order to switch production facilities from producing heating oil to reformulated unleaded gasoline in anticipation of heavy demand for the upcoming summer driving season. This has refiners buying crude oil in order to ramp up production for gasoline. Last year, crude bottomed in mid-February and that bottom was the end of crude’s multi-year bear market that began in earnest in 2014. The result was the second best performance in this trade’s history going back to 1984. Only 2008 was better.

Courtesy of AlmanacTrader

Read More, Comment and Share......

Apple doesn’t have a solid TV strategy yet. But CEO Tim Cook thinks he can see the writing on the wall—the much loathed cable-TV bundle is on its deathbed.

Apple doesn’t have a solid TV strategy yet. But CEO Tim Cook thinks he can see the writing on the wall—the much loathed cable-TV bundle is on its deathbed.

Speaking on the earnings call after Apple posted a record first quarter, Cook said (emphasis added):

The way that we participate in the changes that are going on in the media industry that I fully expect to accelerate from the cable bundle beginning to break down is, one, we started the new Apple TV a year ago, and we’re pleased with how that platform has come along. We have more things planned for it but it’s come a long way in a year, and it gives us a clear platform to build off of.

Apple is on the fourth generation of the Apple TV. It now has an app that makes recommendations across streaming-video services and has a universal search function; it is currently limited by only allowing you to find a program across a limited selection of third-party services, but it has the potential to become the online equivalent to a TV Guide for all programming. (The company is also developing a library of original content tied to its Apple Music subscription.)

Media experts have been forecasting the death of the traditional TV bundles for years (BTIG Research media analyst Rich Greenfield tweets with the hashtag “#goodluckbundle”)—and it hasn’t happened yet. But there has definitely been some movement, as Cook pointed out.

Popular cable networks like ESPN are losing subscribers because of unbundling, cord-cutting is becoming more common, TV brands like HBO offer their own subscriptions on platforms like Apple TV, and streaming services like Netflix are hitting member records.

So far, bundling hasn’t as yet disappeared in the US. It’s just taken on new forms.

Companies like Verizon have released slimmed-down packages that allow customers to cherry pick the channels they pay for. Dish Network’s SlingTV, Sony’s Playstation Vue, and AT&T’s DirecTV Now, among others, offer live and on-demand TV packages through the internet. And Hulu and YouTube are expected to introduce live TV offerings this year.

None of these packages seem to top the user experience that you get with cable yet. But they have their benefits—they’re more affordable, the video quality is improving, and their customer-support teams can’t possibly be as miserable to deal with as those at the cable company.

But with Apple, and now Facebook, expanding into the TV business, a real contender that could take down cable might soon emerge.

Courtesy of QZ

Read More, Comment and Share......

In a high-profile attack on growth-killing red tape, President Donald Trump this week ordered that any agency issuing a new rule find two to repeal.

In a high-profile attack on growth-killing red tape, President Donald Trump this week ordered that any agency issuing a new rule find two to repeal.

He will likely discover that the only thing harder than getting something done in Washington is getting it undone.

Vast swaths of rules are untouchable because Congress ordered them to be written or the president himself demanded them. Finding rules to repeal is a tedious and time-consuming affair that usually yields tiny savings, mostly in reduced paperwork. Ultimately, rules are passed because they have benefits, from cleaner air to fewer terror attacks, that voters or presidents aren’t willing to forgo.

The first president to tackle the leviathan was Jimmy Carter who proposed a “regulatory budget” to limit the financial burden of new rules. Every president since has tried the same. George W. Bush invited suggestions from the public on rules to repeal. Barack Obama trumpeted two executive orders requiring federal agencies to “look back” and kill off old rules that no longer justified their cost.

None halted the relentlessly rising burden of regulation.

Perhaps Mr. Trump will be different, but history offers reason for skepticism.

In a sample of 50 of Mr. Obama’s “look-backs,” 76% achieved their savings by reducing administrative costs, such as converting to electronic from paper filing, according to Cary Coglianese, director of the University of Pennsylvania’s Penn Program on Regulation. Such costs are trivial compared with compliance, such as installing pollution abatement equipment or wheelchair ramps, and lost business opportunities.

Often, the rules that get repealed “nobody cares about anymore: they aren’t imposing any costs at all because things have moved on,” Mr. Coglianese says. In 2004, for example, a rule protecting consumers from airlines’ deceptive airline ticket sales was repealed. It didn’t matter much because airlines no longer owned the major reservation systems.

Canada and Britain, which have versions of Mr. Trump’s “one in, two out” order, don’t offer much prospect for radical rollback.

“There were very few instances where we repealed regulation outright,” says Jitinder Kohli, who ran Britain’s regulatory overseer from 2005 to 2009 and is now with Deloitte Consulting. “It was very rare that the original intent of the regulation no longer made sense.”

More often, he said, there were more efficient ways to carry out the rule. Britain now mandates £3 of regulatory cost reduction for each pound of cost increase, yet its national auditor has found that costs are so poorly understood, it is unclear what good the government has achieved. For its part, Canada’s regulatory reduction program only covers paperwork costs.

Mr. Trump’s order requires the costs of any new rule be fully offset by repealed rules in any given year, but has yet to specify how to measure those costs. No cost estimate exists for many rules, and those that do haven’t been updated since the rules were passed.

Much of what business spends complying with a rule, such as designing more fuel-efficient cars, is “sunk,” and can’t be recovered. “The regulated party may even resist change,” says Susan Dudley, a Bush regulatory official and now director of the George Washington University Regulatory Studies Center. Dropping the requirement for air bags, for instance, won’t make car manufacturers stop installing them.

Mr. Trump’s order could provide a powerful prod to agencies to look for old, costly rules since, if they can’t find any, they may be unable to issue new rules. Even so, laws and courts can still demand that rules be written. Mr. Trump wants to repeal Mr. Obama’s Clean Power Plan. He would still be faced with a 2007 Supreme Court decision that the Environmental Protection Agency regulate carbon-dioxide emissions under the Clean Air Act.

There are more effective albeit less sexy ways to improve regulation: standardize the measure of both costs and benefits, force both Congress and federal agencies to submit laws and major new rules to independent cost-benefit analysis, then mandate a reassessment of the results several years later.

Yet the regulatory burden will likely keep growing so long as the priorities of Congress and the president require it. After the Sept. 11, 2001, terrorist attacks, Mr. Bush created an entire new federal department with thousands of new employees to counter terrorism. Mr. Obama’s health care and financial regulation laws required agencies to issue thousands of rules regardless of their costs and benefits.

Mr. Trump may not be not immune. He enacted a temporary ban on visitors from seven mostly Muslim countries over concerns that terrorists might enter the U.S. The president also suspended the U.S. refugee program for four months and reduced the number of refugees the U.S. will accept in fiscal year 2017 to 50,000. How would this perform on a cost-benefit test?

Alex Nowrasteh, an immigration expert at the libertarian Cato Institute, estimates the average American has a one in 3.6 billion chance each year of being killed by a refugee who becomes a terrorist, meaning there is a small benefit from the new rule. At the same time, he puts the cost of Mr. Trump’s order at $350 million per life saved since fewer immigrants make the workforce less efficient. By comparison, federal guidance usually puts the statistical value of a human life at $10 million.

Which simply proves that when a president’s priorities are at stake, the cost of regulation is seldom an object.

Courtesy of WSJ

Read More, Comment and Share......

Auto loans have shot past the $1 trillion mark in the United States and now make up a significant component of the overall consumer debt picture.

Subprime auto loans – which are riskier loans made to customers with poor credit – have helped to drive the market since the Great Recession. However, with auto loan delinquencies ticking up in recent months, investors have been searching for answers about the sector.

Are we in for some sort of subprime auto loan crisis, or is there another explanation for what is going on?

The data and perspective in today’s infographic comes from consumer credit reporting agency Equifax, and it helps to explain what is potentially going on in today’s auto loans market.

Does the recent uptick in auto loan delinquencies represent the unhinging of the market, or is it just standard fare?

The auto loan market is surprisingly diverse, and it’s comprised of many different types of lenders.

Each lender has a unique set of criteria for their ideal customer. For example, banks want very little risk and typically only lend to customers with prime credit scores (620 or higher). Dealer finance companies, on the other hand, are willing to take on more risk in their portfolios, and usually key in on subprime customers.

In fact, there are six different types of lenders in the auto lending space:

Because they each approach the market differently, there is strong segmentation in the market. The following chart from Equifax shows a snapshot of loans made in Q1 of 2015 and their cumulative non-performance after 18 months on the books:

However, let’s look at this again by plotting the median credit score for new loans originated in Q1 of 2006, 2009, 2012, and 2015.

After the financial crisis, banks tightened credit standards until performance improved. Monoline and dealer finance companies, on the other hand, continued to lend to high-risk borrowers – and it is these companies that are seeing non-performance rates shifting higher.

In other words, it is the market share and relative performance among lenders that are the change drivers for aggregate loan statistics.

Read More, Comment and Share......

Read More, Comment and Share......

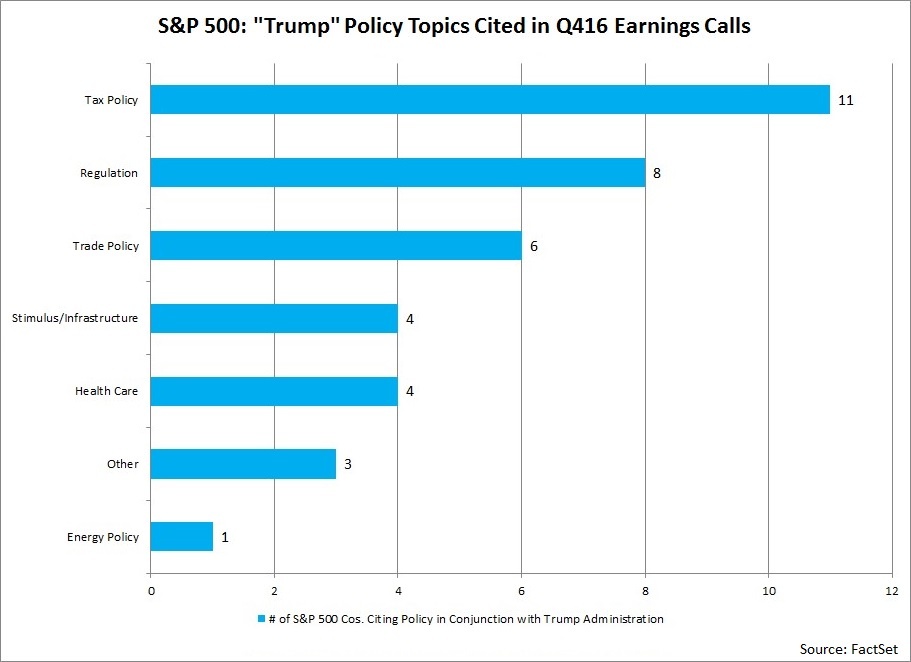

With Inauguration Day here, politics and government policy will continue to be a focus area for the markets. Over the past few months, President Trump has outlined a number of areas for potential changes in government policy.

During each corporate earnings season, it is not unusual for companies to comment on subjects that had an impact on their earnings and revenues for a given quarter or may have an impact on earnings and revenues for future quarters. While the majority of S&P 500 companies will report earnings results for Q4 2016 over the next few weeks, approximately 8% of the companies in the index (42 companies) have already reported earnings results for the fourth quarter (through Wednesday). Have companies in the S&P 500 been commenting on government policies that may change under the Trump administration during their earnings conference calls for the fourth quarter?

To answer this question, FactSet searched for the terms “Trump” and “administration” in the conference call transcripts of the 42 S&P 500 companies that have conducted fourth quarter earnings conference calls through January 18 to see how many companies discussed these terms. FactSet then looked to see if the company cited or discussed a policy topic in conjunction with the citation of “Trump” or “administration.” The results are shown below.

Of the 42 S&P 500 companies, 27 cited the term “Trump” or “administration” during their Q4 earnings calls. The term “administration” was only counted if it was used to reference the Trump administration.

In terms of government policies in conjunction with the new administration, tax policy was cited or discussed by the highest number of S&P 500 companies at 11. Six of these 11 companies stated that if taxes were lowered, it would benefit their clients or themselves.

Please note that companies that cited or discussed a potential border tariff or tax were counted under “Trade Policy” and not “Tax Policy” in the chart. Please also note the numbers will not total to 27, as some companies discussed multiples policy topics, while others did not discuss any specific policy topics.

“I think when you say indirect and direct, you mean direct, obviously, we've been a relatively high taxpayer. And so to the extent to which tax rates come down, we're a beneficiary. But obviously, changes in tax policy can be a huge catalyst for how all of our clients think about deploying their capital, strategic decisions.” –Goldman Sachs (Jan. 18)

“Well, I just want to echo what you just said that we are starting to have conversations with clients that are indicating they are more optimistic business owners around possibilities of increased economic growth and maybe some tax relief or other things that might come with the new administration yet to be determined.” –Comerica (Jan. 17)

“And then the other item that I mentioned is the tax reform that's being discussed. I see Delta certainly being a beneficiary of that, though it's hard to speculate as to the form it will take, given its very early.” –Delta Air Lines (Jan. 12)

“Well, certainly, we've seen a lot of positive sentiment. And at this point in time, it's just sentiment. And so we've got a ways to go before we see anything impactful. But having said that, look, if we see lower corporate income tax rates that will be certainly beneficial for us because we're mostly a U.S-based company.” –Cintas (Dec. 22)

“We haven't started doing modeling at this point because at that point, the benefit – okay, so that's coupled with a bigger discussion about whether corporate tax rates go down. If that happens then, even if we face some drag from personal income taxes, the corporate tax impact simply dwarfs everything else so that we'd look at both. So if tax reform occurs, it's pretty obvious that we would be a pretty significant beneficiary. By significant, I mean very significant. So we're waiting to hear like everyone else is waiting to hear.” –Paychex (Dec. 21)

“The bigger issue for all of you to look at longer term for us is the features that are in the GOP blueprint and President-elect Trump's plans that we like a lot, and those include materially lowering the tax rate, the effective territorial treatment of foreign earnings, and current expensing of CapEx. We think that will positively impact our top line through stronger economic growth and, of course, the bottom line potentially in a very big way through the lower tax rate.” –FedEx (Dec. 20)

Courtesy of FactSet

Read More, Comment and Share......

Marking a major milestone in home entertainment’s shift to digital formats, video streaming subscription revenues surpassed DVD / Blu-ray sales in the United States for the first time in 2016. While U.S. consumers spent $6.23 billion on subscriptions to services such as Netflix (up 23% from 2015), DVD and Blu-ray sales dropped 9.5 percent to $5.49 billion, according to the Digital Entertainment Group's year-end report.

Looking at the home entertainment market as a whole, it is clear that the future of video distribution is digital. While consumer spending on streaming subscriptions, video on demand and electronic sell-through increased in 2016, all physical formats, both sell-through and rental, suffered double-digit declines. Digital business models now account for 56% of home entertainment spending and could soon surpass box office earnings to become the largest source of income for the entertainment industry.

Read More, Comment and Share......

There is a global push by lawmakers to eliminate the use of physical cash around the world. This movement is often referred to as “The War on Cash”, and there are three major players involved:

1. The Initiators

Who?

Governments, central banks.

Why?

The elimination of cash will make it easier to track all types of transactions – including those made by criminals.

2. The Enemy

Who?

Criminals, terrorists

Why?

Large denominations of bank notes make illegal transactions easier to perform, and increase anonymity.

3. The Crossfire

Who?

Citizens

Why?

The coercive elimination of physical cash will have potential repercussions on the economy and social liberties.

Cash has always been king – but starting in the late 1990s, the convenience of new technologies have helped make non-cash transactions to become more viable:

By 2015, there were 426 billion cashless transactions worldwide – a 50% increase from five years before.

| Year | # of cashless transactions |

|---|---|

| 2010 | 285.2 billion |

| 2015 | 426.3 billion |

And today, there are multiple ways to pay digitally, including:

The success of these new technologies have prompted lawmakers to posit that all transactions should now be digital.

Here is their case for a cashless society:

Removing high denominations of bills from circulation makes it harder for terrorists, drug dealers, money launderers, and tax evaders.

This also gives regulators more control over the economy.

Cashless transactions are faster and more efficient.

But for this to be possible, they say that cash – especially large denomination bills – must be eliminated. After all, cash is still used for about 85% of all transactions worldwide.

Governments and central banks have moved swiftly in dozens of countries to start eliminating cash.

Some key examples of this? Australia, Singapore, Venezuela, the U.S., and the European Central Bank have all eliminated (or have proposed to eliminate) high denomination notes. Other countries like France, Sweden and Greece have targeted adding restrictions on the size of cash transactions, reducing the amount of ATMs in the countryside, or limiting the amount of cash that can be held outside of the banking system. Finally, some countries have taken things a full step further – South Korea aims to eliminate paper currency in its entirety by 2020.

But right now, the “War on Cash” can’t be mentioned without invoking images of day-long lineups in India. In November 2016, Indian Prime Minister Narendra Modi demonetized 500 and 1000 rupee notes, eliminating 86% of the country’s notes overnight. While Indians could theoretically exchange 500 and 1,000 rupee notes for higher denominations, it was only up to a limit of 4,000 rupees per person. Sums above that had to be routed through a bank account in a country where only 50% of Indians have such access.

The Hindu has reported that there have now been 112 reported deaths associated with the Indian demonetization. Some people have committed suicide, but most deaths come from elderly people waiting in bank queues for hours or days to exchange money.

The shots fired by governments to fight its war on cash may have several unintended casualties:

1. Privacy

2. Savings

3. Human Rights

4. Cybersecurity

As the War on Cash accelerates, many shots will be fired. The question is: who will take the majority of the damage?

Courtesy of Infographics

Read More, Comment and Share......

The impending IPO of Snap Inc., the parent of social media platform Snapchat, is shrouded in mystery, typical of the way business is run at the company. To maintain control of the company, its founders Evan Spiegel and Bobby Murphy are expected to reportedly hold about 70 percent of the voting power following the IPO, with new investors getting no voting rights.

The impending IPO of Snap Inc., the parent of social media platform Snapchat, is shrouded in mystery, typical of the way business is run at the company. To maintain control of the company, its founders Evan Spiegel and Bobby Murphy are expected to reportedly hold about 70 percent of the voting power following the IPO, with new investors getting no voting rights.

Notwithstanding the limited visibility into the IPO, advertisers are warming up to Snapchat. Ad firm WPP's CEO Martin Sorrel told CNBC that its clients spend about $90 million on Snapchat in 2016, which is a notable increase from the $30 million WPP predicted at the start of the year. Given the ad spend statistics, Sorrel believes the company's total revenues could be higher than what the markets have been anticipating.

Quarterly filing by Facebook Inc FB 0.64% showed that ad revenue totaled $6.82 billion in the September quarter of 2016, with 50 percent of it coming from the United States and Canada. Ad revenues for 2015 was at $17.08 billion.

In comparison, Twitter Inc TWTR 1.74% saw advertising revenues rise 6 percent year-over-year to $545 million in the September quarter of 2016, with mobile advertising making up 90 percent of the total. For 2015, advertising revenues totaled $1.99 billion, a 59 percent increase.

Investing To Boost Ad Dollars

The success in raking in ad dollars has prompted Snapchat to test two features this month in Snap Ads, according to Mashable. Making it easier for advertisers to meet their targets, Snap is providing for deep-linking, allowing video ads inserted between Stories or on Discover.

Another feature called the auto-fill feature allows advertisers offering user sign-ups forms to have some of the details auto filled from information about users already available with Snapchat. Thus, Snapchat's ad business will begin to look more like Facebook's.

A TechCrunch report suggested that Snapchat is adding a universal search bar at the top of the app, allowing users instantly search for friends, groups, curated Our Stories, etc. This feature could also help increase ad revenues through search advertising. Additionally, through the user search, Snapchat gets privy to behavioral data that can be used for targeted ads.

Separately, Michael Lynton, the CEO of Sony Entertainment has decided to quit his position at the Japanese firm and would join Snap in the next six months.

Courtesy of Benzinga

Read More, Comment and Share......

President-elect Donald Trump suggested he would be open to lifting sanctions on Russia and wasn’t committed to a longstanding agreement with China over Taiwan—two signs that he would use any available leverage to realign the U.S.’s relationship with its two biggest global strategic rivals.

President-elect Donald Trump suggested he would be open to lifting sanctions on Russia and wasn’t committed to a longstanding agreement with China over Taiwan—two signs that he would use any available leverage to realign the U.S.’s relationship with its two biggest global strategic rivals.

In an hourlong interview, Mr. Trump said that, “at least for a period of time,” he would keep intact sanctions against Russia imposed by the Obama administration in late December in response to Moscow’s alleged cyberattacks to influence November’s election. But he suggested he might do away with those penalties if Russia proved helpful in battling terrorists and reaching other goals important to the U.S.

“If you get along and if Russia is really helping us, why would anybody have sanctions if somebody’s doing some really great things?” he said.

He also said he wouldn’t commit to America’s agreement with China that Taiwan wasn’t to be recognized diplomatically, a policy known as “One China,” until he saw what he considered progress from Beijing in its currency and trade practices.

THE TRUMP TRANSITION

The desire to change relations with Moscow in particular has been a goal of American presidents since tensions began rising under President Vladimir Putin’s leadership. Former Secretary of State Hillary Clinton sought the same goal early in the Obama administration, as did President George W. Bush, who met Mr. Putin early in his first term.

But Mr. Trump’s diplomatic efforts will have to compete with those in Congress, including many Republicans, who want to see the administration take a tough line with Russia after U.S. intelligence concluded that the government of Mr. Putin sought to influence the November presidential election with a campaign of cyberhacking.

Additionally, an unsubstantiated dossier of political opposition research suggesting ties between Mr. Trump and Russia was published this past week—drawing condemnation from Mr. Trump and his team but keeping Russian espionage in the spotlight. The allegations haven’t been validated by the U.S. intelligence agencies.

Mr. Trump in the interview suggested he might do away with the Obama administration’s Russian sanctions, and he said he is prepared to meet with Mr. Putin some time after he is sworn in.

“I understand that they would like to meet, and that’s absolutely fine with me,” he said.

Asked if he supported the One China policy on Taiwan, Mr. Trump said: “Everything is under negotiation including One China.”

China has considered Taiwan a breakaway province since Chiang Kai-shek’s Nationalists set up a government there in 1949, after years of civil war. Washington’s agreement to rescind diplomatic recognition of the government in Taiwan and uphold a One China policy was a precondition for the re-establishment of diplomatic relations between U.S. and China in 1979. Any suggestion in the past that the U.S. may change its stance has been met with alarm in Beijing.

On Saturday, a statement posted on the Chinese foreign ministry’s website said, “There is but one China in the world, and Taiwan is an inalienable part of China.”

It added, “we urge relevant parties in the U.S. to fully recognize the high sensitivity of the Taiwan question, approach Taiwan-related issues with prudence and honor the commitment made by all previous U.S. administrations.”

Though he has long been critical of China, Mr. Trump on Friday also made a point of showing a holiday greeting card he received from China’s leader, Xi Jinping.

“I have a beautiful card from the chairman,” he said.

Mr. Trump seemed impatient with diplomatic protocols involving China and Taiwan. After his victory he took a congratulatory phone call from Taiwan’s leader, triggering objections from Beijing and stoking concerns among some U.S. foreign policy experts who questioned whether he understood the implications of such a conversation.

Speaking of Taiwan, he said: “We sold them $2 billion of military equipment last year. We can sell them $2 billion of the latest and greatest military equipment but we’re not allowed to accept a phone call. First of all it would have been very rude not to accept the phone call.”

Mr. Trump has said in the past he would label China a currency manipulator after he takes office. In the interview, he said he wouldn’t take that step on his first day in the White House. “I would talk to them first,” he said.

He added: “Certainly they are manipulators. But I’m not looking to do that.”

But he made plain his displeasure with China’s currency practices. “Instead of saying, ‘We’re devaluating our currency,’ they say, ‘Oh, our currency is dropping.’ It’s not dropping. They’re doing it on purpose.

“Our companies can’t compete with them now because our currency is strong and it’s killing us.”

The interview came at the end of the week in which Mr. Trump saw much of his national-security team get closer to their appointments but had to push back against the Russia allegations and against criticism from ethics experts of his plan to maintain ownership of his business interests.

Six of his cabinet choices had confirmation hearings, and a number look likely to sail through. Many Democrats offered eager support for his pick for defense secretary, retired Gen. James Mattis.

Mr. Trump also brought his son-in-law, Jared Kushner, on as a senior White House adviser, although the appointment could be challenged under antinepotism laws. And he got closer to fulfilling a campaign promise as the Senate and then the House took procedural steps that begin rolling back or repealing the Affordable Care Act.

“He got elected as a fighter and he’s going to be president as a fighter,” said Ed Brookover, a former Trump campaign adviser. He added that Mr. Trump “is going to be a very active president and push a lot of buttons along the way.”

At a jam-packed news conference on Wednesday morning, Mr. Trump was both combative and flattering, shouting down one journalist but praising news outlets who he said covered him fairly. During the session, he accused intelligence agencies of allowing the dossier information to be leaked, and on Twitter he said they were employing the tactics of Nazi Germany. James Clapper, the director of national intelligence, said he doesn’t believe intelligence officials leaked the information.

Amid a flurry of questions about the dossier, Mr. Trump avoided most direct answers and made just one admission. For the first time, he said he agrees that Russia was behind the cyberattack on the Democratic National Committee and a top aide to campaign rival Mrs. Clinton during the election.

He also tossed in the announcement of his pick to lead the Department of Veterans Affairs, said he would sign executive orders beginning on Jan. 23, and promised to begin negotiating drug prices with pharmaceutical companies to drive costs down.

Questions about his refusal to divest himself of business holdings lingered, though. A few hours after his press conference, U.S. Office of Government Ethics Director Walter Shaub criticized Mr. Trump’s new business arrangement, saying his actions were insufficient to remove potential conflicts.

“Every president in modern times has taken the strong medicine of divestiture,” Mr. Shaub said. “Officials in an administration need their president to show that ethics matter, not only through words but through deeds. This is vitally important if we’re going to have any kind of ethics program.”

On Thursday, Gen. Mattis, testifying before the Senate Armed Services Committee, appeared to buck Mr. Trump numerous times, questioning the motives of Mr. Putin, lauding the North Atlantic Treaty Organization and saying the U.S. should closely monitor Iran’s compliance with a nuclear agreement, but he stopped short of rejecting the deal, as Mr. Trump has.

Gen. Mattis also suggested that some national security discussions could be contentious, which he said would lead to the best outcomes.

“It’s not tidy,” he said of the process he is expecting. “It’ll anticipate that anything but the best ideas will win.”

A day earlier, Rex Tillerson , the pick for secretary of state, had told lawmakers he supported arming Ukraine against Russia and said he was supportive of a trade deal Mr. Obama struck with Asian countries, two statements that conflict with Mr. Trump’s platform.

Later that night, House Speaker Paul Ryan (R., Wis.) said during a CNN town hall that he was working closely with the president-elect to repeal the health-care law but shot down the idea that there would be a “deportation force” to remove illegal immigrants from the U.S. Mr. Trump had said during the campaign that there would be such a force.

Later in the week, Mr. Trump weighed in on the latest development of the issue that dominated the end of the campaign.

He has spent weeks trying to deflect criticism about his election victory, as Democrats argued that Mrs. Clinton had been sandbagged by the Federal Bureau of Investigation’s handling of a probe into whether her private email server had been hacked and whether classified material was improperly moved on it.

The FBI ultimately brought no charges, and on Thursday, the Justice Department’s inspector general confirmed it had opened an investigation into decisions by FBI Director James Comey to make public, days before the election, that agents were scouring a new batch of emails for possible examples of misdeeds by Mrs. Clinton while she was at the State Department. Such a revelation shortly before an election was very unusual.

Mr. Trump on Friday tweeted that the FBI was “VERY nice to her,” adding she “should never…have been allowed to run – guilty as hell.”

In another matter, Mr. Trump during Friday’s interview described a special council, made up of 15 to 20 builders and engineers, that would monitor spending on his $1 trillion plan to improve the nation’s roads, bridges and other public works.

“Some of the projects they’ll throw out, some of the projects they’ll expand, but all of the projects they’ll make sure we get a tremendous bang for the buck,” Mr. Trump said.

Courtesy of WSJ

Read More, Comment and Share......

Every year the silicon computer chip shrinks in size by half and doubles in power, enabling our devices to become more mobile and accessible. But what happens when our chips can't get any smaller? George Tulevski researches the unseen and untapped world of nanomaterials. His current work: developing chemical processes to compel billions of carbon nanotubes to assemble themselves into the patterns needed to build circuits, much the same way natural organisms build intricate, diverse and elegant structures. Could they hold the secret to the next generation of computing?

Read More, Comment and Share......